A recent InfoComm International report published suggests that the video display sector is set to climb one place to become the fourth largest AV market field by 2018, replacing the current holders of that position, video projection.

Conducted by the industry body, in collaboration with information, analytics and solutions organisation IHS Markit, the InfoComm Outlook and Trends Analysis (IOTA) project examined detailed figures collected from a sample of key vendors, and sourced buyer-side data from segments including: broadcast media, education, the government, hospitality, retail, plus security surveillance. Statistics collated within previous investigative efforts have been reinforced by additional primary and secondary research and comprehensive macroeconomic forecasting for the project.

IOTA predicts a positive outlook on industry market trends through 2022. Regardless of prognostications that global GDP growth will continue to decline slightly over the next couple of years (falling from 6.7% to 6.1% in 2019), report results suggest a maintained increase in AV revenues. It is expected that there will be a rise from $178.4 billion in 2016 to $198.7 billion in 2019, up to indications of an escalation of more than 29% in 2022, where total revenue will peak at $231 billion.

The report highlighted that AV market growth will be driven by new buyers in the marketplace incorporating technology into their businesses. The conventional corporate market is anticipated to remain as the largest buyer segment (at a projected value of $46 billion globally in 2022), yet will have grown by a margin of just over 8% from 2016. Collectively, the next four biggest sectors – venues & events, media & entertainment, retail and education – will proliferate by a huge 37% meanwhile, to an amalgamated 2022 worldwide market size of $108.9 billion.

Projected growth by the visual display market is down to strengthened consumer confidence according to IOTA. The report anticipates the demand for digital signage to increase further, fuelled by the emergence of new key markets. For example, retail space owners are increasingly turning to LED screen systems to attract and engage customers, facilitating more opportunities for multiplied sales to an area relatively untouched by the technology previously. LED display innovations and its ubiquitous quality – coupled with reduced component costs enabling greater availability to target markets – has led to the upsurge in sales.

Recent discoveries of new market verticals combined with the upward trend of digital out-of-home (DOOH) displays used for brand marketing and advertising, has developed a self-perpetuating ecosystem for the generation and distribution of video content, in turn maximising the demand for display systems.

Establishing fourth position in the AV industry market size rankings has come at the expense of video projection. It is estimated that projection will experience the most substantial decline of all markets evaluated, dropping to eighth position in 2022. Revenue figures which stood at around $28.3 billion in 2014 is analysed to fall by approximately 62% to $10.8 billion in 2022.

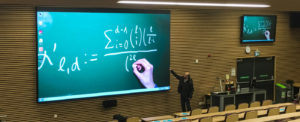

The convenience and class of LED screens has impacted the projection market, leading to the statistics portraying significant decline ahead. Higher education settings, for instance, are shifting to high-quality, leading-edge LED displays for advertising efforts and to communicate core messages to students, showcasing their credentials to attract the most talented individuals. Identified as the perfect technology for universities, LED displays offer: supreme brightness performance in areas requiring adequate ambient lighting levels for note-taking, a long lifetime (ideal for a high-use environment), increased immersivity through module creation to scale to any size or angled configuration, and avoid obstructed views and alignment issues commonly posed by projector systems.

This article has been based upon an original article by T. Frost, published in the July/August 2017 edition of Installation magazine & http://www.installation-international.com/analysis-infocomm-outlook-trends/

Statistics source: InfoComm International, 2017 AV Industry Outlook and Trends Analysis (studies conducted by IHS Markit on behalf of InfoComm International and information taken from www.infocomm.org/iota)